10 Largecaps Stocks To Lead Bulls Charge

These stocks offer the best combination of maximum ‘buy’ recommendations from brokerages and share price upside over the next 12 months.

Largecaps are currently trading at a valuation discount to mid and smallcap stocks and this has made them attractive.

Krishna Kant and Ram Prasad Sahu/Business Standard look at 10 stocks from the Nifty50 or Nifty Next 50 baskets, based on brokerage recommendation and share price upside over the next 12 months, that potentially could lead the rally in largecaps when the tide turns.

Largecap stocks have grossly underperformed the broader market in the past year.

The benchmark NSE Nifty50 is up 17.5 per cent in the past 12 months, against a 30 per cent rally in the Nifty MidCap 150 and nearly a 33 per cent rise in the Nifty SmallCap 250 during the period under review.

This has resulted in a relatively poor showing by leading stocks that are part of the Nifty50 and Nifty Next 50 indices as compared to the mid and smallcap stocks.

This underperformance has also resulted in largecap stocks trading at a valuation discount to mid and smallcap stocks, which is unusual.

For example, the Nifty50 index is valued at a trailing price-to-earnings (P/E) multiple of 22.74x, a nearly 13 per cent discount to the Nifty MidCap 150 index’s P/E of 26.14x.

Similarly, the benchmark index is trading at a nearly 9 per cent discount to the Nifty SmallCap 250’s trailing P/E of 24.7x, according to NSE data.

This has made largecaps more attractive compared to mid and smallcap stocks.

Historically, the rally in mid and smallcap stocks and that in largecap stocks follows a cycle and it’s a matter of time when largecap stocks will once again start outperforming the broader market.

Here are 10 largecap stocks that are likely to be the rally leaders.

The selection is based on the 12-month forward price target of brokerages of the 100 stocks that are either part of the Nifty50 or Nifty Next 50 indices.

These stocks offer the best combination of maximum ‘buy’ recommendations from brokerages and share price upside over the next 12 months.

Life Insurance Corporation of India

- LIC’s stock price has recovered in the past six months following a sharp decline after its listing in May 2022.

- Analysts expect the momentum to continue driven by attractive valuation and strong growth in premium income.

- The stock is expected to gain from cyclical tailwind for life insurance companies, after two years of poor showing due a rise in death claims on account of the COVID-19 pandemic.

- Analysts also expect LIC’s enterprise value to improve, aided by continued growth in its premium income and an improvement in the value of new business (or VNB).

- Trailing P/E of 9.1x and price-to-book value (P/BV) of 9x is also lower than its private sector counterparts.

- On average, analysts expect a 20 per cent upside in LIC’s stock as compared to a 9 per cent gain in the Nifty50 over the next 12 months.

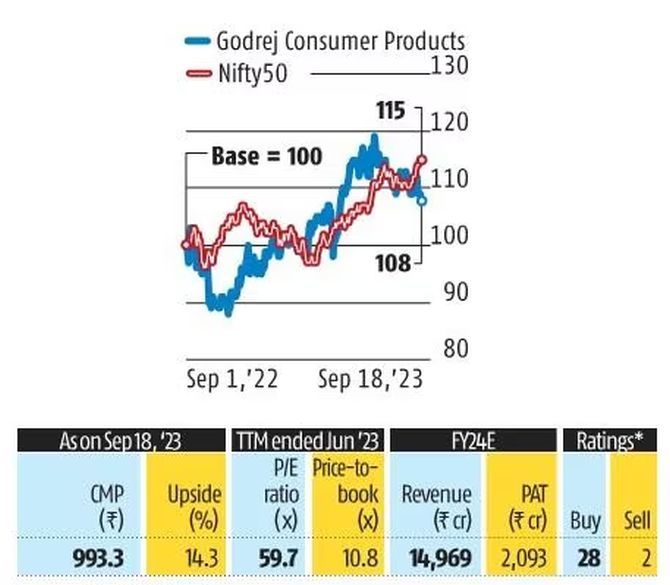

Godrej Consumer Products

- The stock of Godrej Consumer Products has been a laggard in recent months but analysts have now upgraded it, led by a turnaround in the soaps and home insecticides maker’s earnings.

- In 12 months, the stock is up 9.1 per cent against a 17.5 per cent rally each in the Nifty50 and Nifty FMCG indices.

- Godrej Consumer’s net sales were up 10.5 per cent year-on-year (Y-o-Y) in Q1FY24, growing faster than 5.1 per cent Y-o-Y growth in the combined net sales of listed FMCG companies in the first quarter.

- The company’s net profit was, however, down 7.6 per cent Y-o-Y in Q1FY24 because of the financial cost related to the acquisition of Raymond’s FMCG business. The effect of this is expected to subside over the next few quarters.

- At a trailing P/E of 60x and 7x its consolidated book value, the stock is trading at a discount to valuations of its peers, such as Dabur India and Hindustan Unilever.

Bharat Petroleum Corporation

- BPCL is one of the top recommendations of brokerages in the oil & gas sector, thanks to a sharp turnaround in its earnings in Q1FY24.

- Analysts expect over 20 per cent upside in BPCL’s stock over the next 12 months, driven by a sharp improvement in marketing margins and higher profitability in the refining business

- BPCL’s net profit has swung to a record high of Rs 10,664 crore in Q1FY24 from a net loss of Rs 6,148 crore in Q1FY23, despite a 6.7 per cent Y-o-Y decline in its net sales in this period.

- Analysts expect refining margins to remain elevated due to strong demand for diesel and aviation turbine fuel (ATF).

- Indian refiners are also likely to benefit from higher European demand for Indian transport fuel due to continued geopolitical uncertainty.

- Trailing P/E of 3.8x and P/BV of 1.5x are among the lowest in the largecap space.

HDFC Bank

- HDFC Bank has been a laggard in recent months and its stock price has underperformed benchmark indices in the past year.

- In the past year, the stock is up by around 10 per cent vis a vis a 17.5 per cent rally in the Nifty50.

- The poor showing was due to muted growth in revenues and earnings reported by the lender in the past two quarters compared to its large peers, such as ICICI Bank and State Bank of India.

- Analysts now expect HDFC Bank to outperform its peers and the broader market, led by an attractive valuation, healthy balance-sheet growth, and synergy gains from its merger with HDFC.

- Brokerages expect over a 24 per cent upside in HDFC Bank’s share price over the next 12 months, higher than other big banks and the broader market.

- The stock’s trailing P/E of 25.3x and P/BV of 4x is in line with its average 10-year valuation.

State Bank of India

- SBI is one of the top picks of brokerages in the largecap space and the banking industry.

- India’s largest lender has reported a sharp rise in its net profit, net interest income, and margins in the past four quarters to become the most profitable bank in the country.

- Analysts expect the operational performance to remain healthy on the back of India’s economic growth, leading to further rise in the share price.

- The stock is up 13.6 per cent in the past 12 months, underperforming the 17.5 per cent rally in the Nifty50.

- Over the next 12 months, brokerages see a 19.3 per cent upside in SBI’s stock — among the best in largecap banks.

- The stock is currently trading at trailing P/E of 9x and P/BV of 1.7x, a significant discount to the valuation of peers, such as HDFC Bank, ICICI Bank and Axis Bank.

InterGlobe Aviation (IndiGo)

- After two years of losses, IndiGo posted a profit (excluding the foreign exchange impact) in FY23 of ~2,650 crore, riding on a record number of passengers and rising yields.

- After a strong Q1 and seasonally weak September quarter, yields are expected to rebound in Q3.

- While prices of ATF have surged, IIFL Research believes that the impact can be neutralised given the strong demand and low competitive intensity.

- IndiGo has made meaningful market share gains in the international business and is strategically well-placed to make incremental gains, says Kotak Research.

- Amid a duopoly kind of a situation, an underpenetrated domestic market (one-fourth of China’s domestic seats per capita), and a 1,000 plane order positions, the market leader is strongly placed to tap growth of the Indian aviation space.

PI Industries

- PI Industries was an outlier in Q1FY24 in the chemicals space with revenue growth of 24 per cent and operating profit margin expansion of 210 basis points led by favourable mix and leverage.

- The company has guided for revenue growth of 18 to 20 per cent YoY over the next couple of years along with consistent margin improvement.

- While growth is estimated to be led by healthy enquiries in the custom synthesis and manufacturing business and new launches in the domestic segment, margin gains will come from operating leverage and product ramp-up.

- Incremental growth is expected to be driven by the recent acquisition in the pharma and custom development, and manufacturing operations segments.

- PI Industries will be creating a differentiated position in the pharma sector by leveraging its core competencies, says Motilal Oswal Research.

Samvardhana Motherson International

- The country’s largest listed auto components player posted a strong performance in the June quarter, registering 72 per cent growth in operating profit on the back of raw material gains and improving efficiencies.

- The company, according to Motilal Oswal Research, should continue to benefit substantially from easing supply-side issues and receding cost headwinds, leading to strong growth and balance sheet deleverage.

- Though there has been a slew of acquisitions, the net debt-to-operating profit ratio remains healthy at 1.4x vis a vis the global peer average of 1.9x.

- Its global presence, an expanding portfolio of powertrain-agnostic products and a wide customer base present a multi-year growth opportunity, highlights JM Financial Research.

- The stock valuation at under 20x its FY25 estimated earnings is attractive.

UPL

- For two quarters now, India’s largest agrochemicals company posted muted numbers on account of a fall in volumes, as well as price corrections.

- While the July-September quarter has been weak, a recovery is expected in the second half of FY24.

- Volumes are expected to recover on the back of improving demand from North and Latin American markets and stable prices.

- Antique Stock Broking expects a Y-o-Y expansion in the margin in H2FY24 aided by liquidation of high-cost inventory, lower raw material prices, and operating leverage benefits supported by volume growth and a lower base.

- A positive in the quarter is the reduction in net debt by $160 million, taking the net debt to $3.2 billion.

- Further debt reduction is expected to come from a stake sale in the specialty chemicals business, which was recently spun off into a wholly-owned entity.

Hindustan Unilever

- While earnings estimates of Hindustan Unilever have been lowered after its Q1 results, brokerages, such as IIFL Research, expect margins to improve over the medium term on the back of a push for premiumisation and a decline in commodity prices.

- Despite a muted Q1, India’s largest listed fast-moving consumer goods maker reported an improvement in the market share during the quarter for three-fourths of its portfolio through better operating efficiencies and a premium portfolio.

- Axis Securities believes that the rural slowdown has bottomed out and should start witnessing recovery on account of increased government spending ahead of the elections, higher urban remittances, and the RBI’s stance on controlling inflation.

- Geojit Research has a ‘buy’ on the stock, which is trading at 49x its FY25 estimated earnings — reasonably lower than its five-year historical average of 58x.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article