Deutsche Bank exec called Trump a 'whale' while courting his business

Deutsche Bank’s eagerness to land Trump as a ‘whale’ client is revealed in New York fraud trial – but the lender privately estimated his net worth at half the $4.2B he claimed in 2011

- ‘We are whale hunting,’ banker Rosemary Vrablic wrote colleagues in 2011

- New York court hears how bank eagerly courted Trump as wealthy client

- Trump’s dealings with Deutsche Bank are central to New York fraud civil case

Deutsche Bank was eager to land ‘whale’ Donald Trump as a client, and eagerly cultivated a relationship that grew from $13,000 worth of revenue to $6 million in two years, according to documents presented Wednesday at the former president’s civil fraud trial.

‘We are whale hunting,’ then-bank managing director Rosemary Vrablic wrote colleagues in November 2011, as she began to forge ties to Trump and his family.

Deutsche Bank’s dealings with Trump are a key issue in New York Attorney General Letitia James’ lawsuit, which accuses Trump, his company and some executives of hoodwinking lenders and insurers by grossly inflating statements of his asset values.

The defendants deny any wrongdoing. They have sought to show that the bank felt delighted, not deceived, by Trump and courted his business.

In 2011, the family was looking for a loan to buy the Doral golf resort near Miami, and Vrablic was eager to land them as clients.

One executive at the bank said that Trump had one of the ‘strongest personal balance sheets we have seen’ — although other documents presented at trial show the lender internally discounted Trump’s $4.2 billion estimate of his own net worth to just $2.4 billion when considering the Doral loan

Former Deutsche Bank managing director Rosemary Vrablic is seen with Jared Kushner. In 2011, she called Trump a ‘whale’ as she sought to land his business for the bank

Deutsche Bank’s dealings with Trump are a key issue in New York Attorney General Letitia James’ fraud lawsuit

Over the next three years, Vrablic’s connection to the Trumps yielded loans for the Doral project, then two others in Chicago and Washington, as well as multimillion-dollar deposits in the bank.

Her division’s revenue from Trump business shot up from about $13,000 in 2011 to a projected $6 million in 2013, according to a bank document prepared for the then-co-chairman, Anshu Jain, before a lunch with Trump in early 2013.

The briefing document suggested ‘key asks’ for Jain to make: ‘Obtain more deposits and investment management assets,’ and ‘strategically discuss leveraging Mr. Trump’s personal and professional network within the real estate industry in NY’ for the bank’s benefit.

And how did it go?

‘It was a very, very nice, productive lunch,’ Vrablic recalled on the stand.

Behind the scenes, she told a colleague at the time in an email: ‘It went great. Donald was low key and demure. Unbelievable. The conversation was fantastic. Not sure he could do it again for a second meeting but hey … miracles can happen.’

Adding that the two were planning to golf together that spring, she wrote: ‘I bet the real D shows up for that one.’

The next year, her direct boss went to lunch with Trump to thank him and ‘ask whether we can work on other opportunities with them,’ according to a document for that meeting.

James maintains that Trump’s allegedly inflated financial statements were critical to netting his company the Deutsche Bank loans at favorable rates, saving him many millions of dollars in interest.

Trump says the financial statements actually underestimated his wealth and that a disclaimer on them absolves him of liability for any problematic figures.

AG James maintains that Trump’s allegedly inflated financial statements were critical to netting his company the Deutsche Bank loans at favorable rates

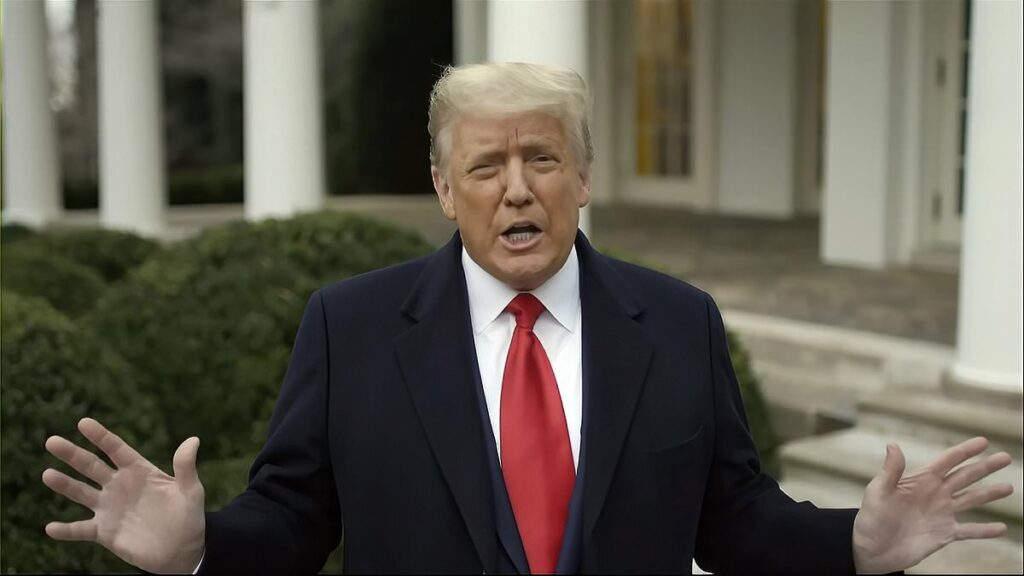

Trump, the current front-runner for the Republican presidential nomination in 2024, claims that James, a Democrat, is trying to harm his prospects of returning to the White House.

‘There was no defaults, no ‘nothing,” he wrote Wednesday on his Truth Social platform, calling the case ‘rigged’ and ‘victimless.’

Trump personally guaranteed the loans at issue – standard practice for lending by Deutsche Bank´s division that caters to rich individuals, Vrablic said.

The deals came with conditions about Trump’s net worth and, sometimes, liquidity, and they often required annual submissions of his financial statements.

Other current and former Deutsche Bank executives have testified that while they expected the information to be accurate, they came up with their own numbers.

Documents show the bank sliced Trump’s $4.2 billion estimate of his net worth to $2.4 billion when considering the Doral loan, for example.

Asked Wednesday whether the cut had concerned her, Vrablic said that if the bank´s credit experts ‘were comfortable with it, I would be comfortable with it.’

The $125 million loan went ahead, with one banker writing in an email that Trump had ‘among the strongest personal balance sheets we have seen.’

A top executive agreed to sign off but insisted on an ‘iron clad’ guarantee from Trump.

Trump provided it, Vrablic said Wednesday.

Trump is questioned next to Judge Arthur Engoron, during the Trump Organization civil fraud trial in New York State Supreme Court earlier this month

Over the years, she and colleagues spoke enthusiastically among themselves about the potential for building on Deutsche Bank’s Trump ties.

The bankers envisioned offering him estate planning services, presenting him investment options and netting more clients through word-of-mouth – ‘given the circles this family travels in, we expect to be introduced to the wealthiest people on the planet,’ Vrablic wrote in a 2011 email.

She advocated within the bank for lending to Trump Organization ventures. In a 2012 email to then-Executive Vice President Ivanka Trump, Vrablic promised to ensure that a Deutsche Bank lending executive knew ‘how important you and your family´s business have become to the bank.’

Eventually, though, the bank started saying no. In 2016, when Donald Trump was on the campaign trail and his company sought a loan for its golf course in Turnberry, Scotland, the bank decided ‘to maintain neutrality to any political situation and not lend money to a highly politically exposed person,’ Vrablic explained in an email at the time to Ivanka Trump.

Vrablic testified Wednesday that the bank was wary of ‘the increased exposure, scrutiny’ surrounding a potential president and concluded ‘that it was not appropriate to go up in exposure.’

Judge Arthur Engoron will decide the verdict. He ruled before the trial that Trump and other defendants engaged in fraud and he ordered that a receiver take control of some of Trump´s properties, putting their future oversight in question. An appeals court has put that order on hold for now.

The trial concerns remaining claims of conspiracy, insurance fraud and falsifying business records. James is seeking more than $300 million in penalties and a ban on Trump doing business in New York.

Source: Read Full Article