Medica + Manipal Will Overtake Apollo

Next year Medica and Manipal will merge, making the amalgamated entity the largest corporate hospital chain in the country, overtaking Apollo Hospitals Enterprises.

Singapore-based investment company Temasek-backed hospitals Manipal Health Enterprises and Medica Synergie Pvt Ltd are likely to merge soon and operate as a single entity under the Manipal brand, sources close to the development said.

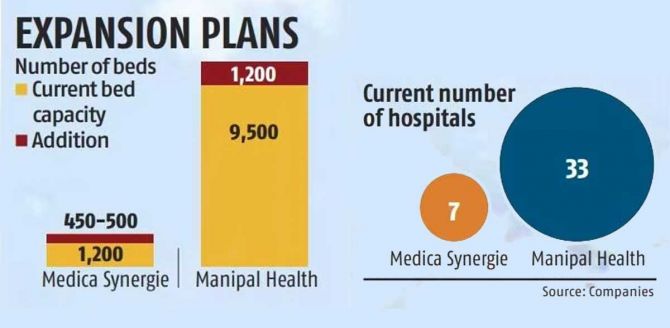

Manipal Health Enterprises (Manipal Hospitals) has a capacity of 9,500 beds in 33 hospitals in India, while Medica has a presence in eastern India with 1,200 beds.

Both the hospitals are in expansion mode — with Manipal Hospitals eyeing another 1,200 beds in 18 to 36 months, and Medica 450 to 500 beds in two-three years.

A source close to the development told Business Standard: “In Manipal Temasek owns around 59 per cent, while in Medica about 90 per cent. Therefore, it makes sense to operate as a single entity to leverage synergies.”

The process will begin in the next few months, and next year Medica and Manipal will merge, making the amalgamated entity the largest corporate hospital chain in the country, overtaking Apollo Hospitals Enterprises, the person quoted above added.

The move will help the hospital groups to collaborate in regional expansion plans and have better hub-and-spoke operations.

Medica has a presence in Kolkata, Siliguri, and Ranchi and is building a cancer hospital in Asansol.

In Kolkata it operates around 600 beds. It is adding capacity to its old Siliguri hospital, which is being developed into a modern 300-bed hospital, and is also expanding in Ranchi.

Speaking to Business Standard, Ayanabh Debgupta, co-founder and joint managing director of Medica, said the entity was mostly focusing on cancer care in its expansion plans.

Cancer care often does not need several beds because many of the treatment procedures can be done in day-care. However, to cater to the growing needs of cancer care in the region, Debgupta said a facility in Asansol was being set up.

“We are also looking at locations like Guwahati and even Varanasi because these are contiguous with our present locations,” he said.

While Debgupta did not give details, he said Medica’s top line had been growing at 20 per cent annually, and the bottom line too has been increasing at a similar pace.

Manipal Hospitals, on the other hand, recently added 1,200 beds through its acquisition of Emami Group-owned AMRI Hospitals for Rs 2,300 crore (Rs 23 billion) in September.

Earlier in April, Temasek had increased its stake in Manipal Hospitals by buying an additional 41 per cent from the promoters and other investors including TPG and the National Investment and Infrastructure Fund at an enterprise valuation of Rs 40,000 crore.

Temasek’s stake in Manipal thus increased from 18 per cent to 59 per cent. Temasek has been invested in Manipal for six years and plans to remain a long-term investor.

In an interaction with Business Standard in September, Dilip Jose, managing director and CEO, Manipal Health Enterprises, had said Manipal Hospitals had 1,300 beds in Kolkata (after the AMRI deal), and it would look at expanding further into Tier-II and smaller towns of West Bengal.

Manipal Hospitals is setting up three hospitals in Bengaluru, totalling 750 beds, and adding another 350 in Raipur.

Manipal Hospitals closed FY23 with revenues of around Rs 4,600 crore (Rs 46 billion)n at a consolidated level, and an Ebitda (earnings before interest, tax, depreciation, and amortisation) of Rs 1,200 crore (Rs 12 billion), resulting in an Ebitda margin of over 25 per cent, market sources said.

It has average revenues per occupied bed of Rs 2 crore (Rs 20 million) at network level, which is on a par with Fortis Healthcare and Apollo Hospital Enterprises, sources added.

Medica co-founder Alok Roy, who was chairman too, exited the hospital group some time ago. Around May the hospital named Nandakumar Jairam chairman.

Temasek’s health care platform Sheares Healthcare had raised its shareholding in Medica to 90 per cent by providing an exit to Roy and related entities.

In December 2021, it had picked up the stake held by Quadria Capital and thereby held a majority of around 75 per cent.

Feature Presentation: Ashish Narsale/Rediff.com

Source: Read Full Article